puerto rico tax incentive program

One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035. A self-governing territory of the US Puerto Rico has authority over its internal affairs including certain exemptions from the Internal Revenue Code.

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Nomad Capitalist

In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

. 60-2019 and previous incentives laws and successfully obtained decrees for tax incentives related to tourism the film industry export services individual foreign investors physicians and young entrepreneurs among others. Incentives Eligible Businesses Financial Report Energy Bill Credit Documents A tax credit equal to 10 of the total project costs or 50 of the cash investment made by investors whichever is less. Puerto Rico offers a highly attractive incentives package that includes a fixed corporate income tax rate one of the lowest in comparison with any US.

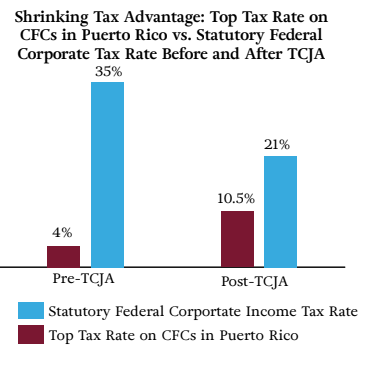

4 fixed corporate income tax rate 0 or 1 income tax on endeavors categorized as pioneer industries 0 tax on owner profit distributions dividends Tax credits for jobs created. The Department of Economic Development and Commerce DDEC implemented the Incentive for Creative Industries whose assigned amount amounts to 3 million for entities and individuals who work on their own in said sector in order to provide an economic reinforcement. These changes impact Puerto Rico because a PR corporation is treated as a foreign corporation for US purposes.

Thousands of Americans have already moved to the US-owned Caribbean island under the program to take advantage of Act 60s tax benefits with Puerto Ricos stunning beaches and vibrant culture serving as two added incentives in favor of the move. It appears that Trumps tax plan is bringing big changes to Puerto Ricos Act 20 tax incentive program. Act as counsel in filing and negotiating multiple tax incentive applications on behalf of clients under Puerto Ricos Code of Incentives Act No.

There is also a major tax incentive for business owners to set down roots in Puerto Rico. Aggressive Tax Incentives for Attracting Business. Pioneer activities can receive a preferential tax rate of 0 to 1.

Puerto Rico Act 22 officially Chapter 2 Individuals of the new Tax Incentives Code can eliminate all of that. DSM Capital Partners LLC does not have any connection with Puerto Ricos tax incentive programs. Part of Puerto Ricos government tax incentive programs require buying a home within the first two years of a move and you have to pay for the privilege of getting lower taxes.

Fixed 4 corporate income tax rate for industries who perform RD as part of their industrial activities. Act 20 offers a 4 income tax rate 100 tax exemption on distributions from earnings and profits and a 90. The Economic Incentives for the Development of Puerto Rico Act offers tax advantages to research and development activities as well as manufacturing.

This is one of Puerto Ricos most popular tax incentive. The purpose of the Export Goods and Services Incentive is to promote the development of new service businesses in Puerto Rico by attracting outside revenue into Puerto Rico and thereby creating new jobsPuerto Ricos goal is to grow Puerto Rico into a hub for international business services. This is done through the formation of investment capital funds aimed at investing in companies that do not have access to public markets and establish the applicable.

Disbanded its Puerto Rico office in 2016 while Mosaic Investment Partners Inc which is still active according to the governments. The fiscal impact of approximately 590M in credits and monetary stimulus excluding tax exemptions and prime taxes. To create two tax incentives in 2012.

Facing empty treasury coffers and rising unemployment rates Puerto Rico took advantage of its special status within the US. Puerto Ricos Act 185 Tax Incentive Program The purpose of the Act 185 tax incentive is to establish the Private Equity Fund Act to promote the development of private capital in Puerto Rico. Mainland companies are subject to a 21 federal corporate tax plus a.

Strategic industries in manufacturing activities and services as well as in export services can enjoy a 4 fixed income tax rate. The following is a list of the incentives available for industries who invest in RD activities in Puerto Rico. All you have to do is move to Puerto Rico become a bona fide resident buy a home make a small annual donation and voila all future capital gains on stocks bonds and even crypto will be tax free.

To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. Note that this article is a. Brokerage firm Fairbridge Capital Market Inc.

The program boasts a 0 capital gains tax rate and a 4 corporate tax rate. This incentive is focused on providing assistance and reaching those who are not eligible under the. You can access the Puerto Rico Tourism Companys Virtual Clerk to request incentives.

Act 73 of May 28. Fixed 1 corporate income tax rate on products manufactured in Puerto Rico by using novel pioneer technologies. Incentives for export activities or to attract investment to develop the Puerto Rico economy in a way that is profitable for Puerto Ricos Government tourism manufacture for exportation exportation services and international investment.

Incentives - Puerto Rico Film Commission Production Incentives 40 Production tax credit on all payments to Puerto Rico Resident companies and individuals Production tax credit on all payments to Qualified Nonresident individuals Persons engaged in qualifying film projects are eligible for the following preferential tax rates and exemptions. Puerto Rico offers the benefits of operating within a United States jurisdiction while providing the tax benefits of a foreign tax structure. We have no involvement in this Among other recipients.

HUD Clarifies Position on Puerto Rico Tax Incentive Program In light of a recent letter from the Appraisal Institute the Department of Housing and Urban Development has reversed its opinion and now views Puerto Ricos Law 197 as a sales incentive or inducement and expects FHA Roster appraisers to appraise such properties accordingly. Here are the changes coming to Puerto Ricos Act 20 tax incentive program. Tax Incentives for Incoming Businesses Investors.

A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US. The Incentives in a Nutshell Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. Jurisdiction various tax exemptions and special deductions training expenses reimbursement and special tax treatment for pioneer activities.

Act 20 and Act 22.

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Cares Act A Lifeboat For Puerto Rico Insights Dla Piper Global Law Firm

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

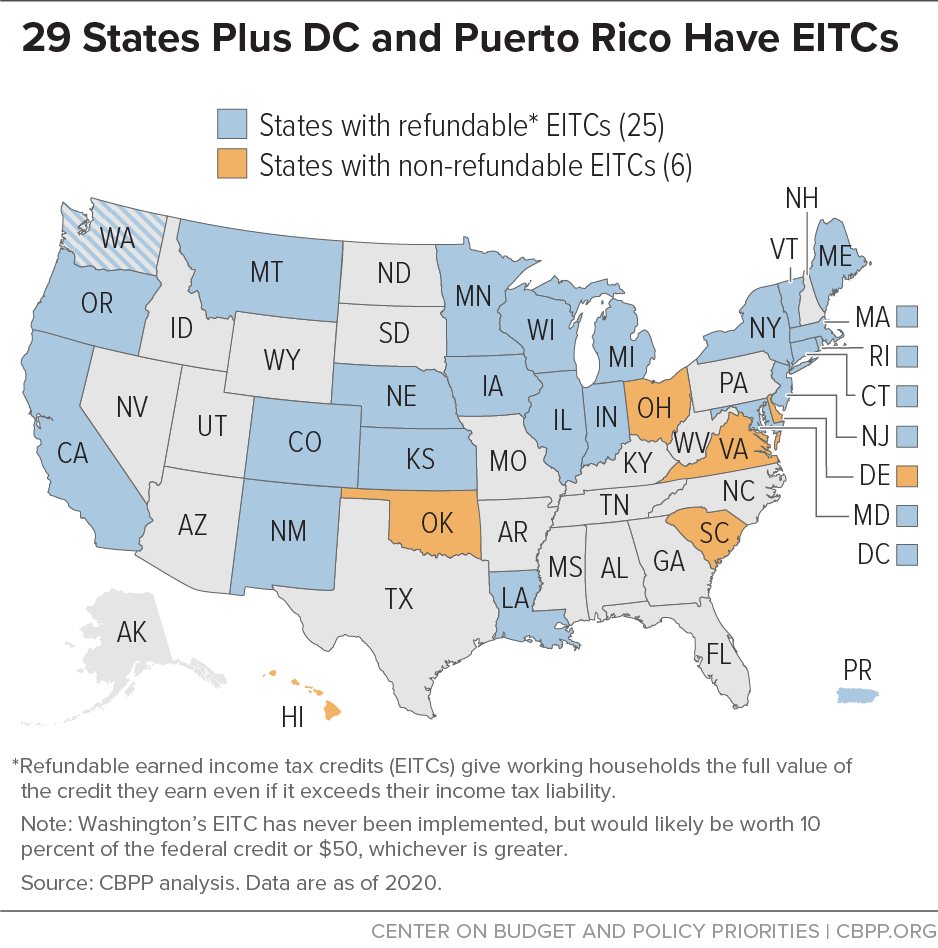

29 States Plus Dc And Puerto Rico Have Eitcs Center On Budget And Policy Priorities

Puerto Rico Offers The Lowest Effective Corporate Income Tax

The Puerto Rico Tax Haven Will Act 20 Work For You

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Puerto Rico Offers The Lowest Effective Corporate Income Tax