cumulative preferred stock formula

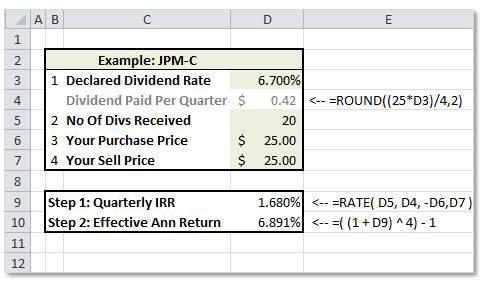

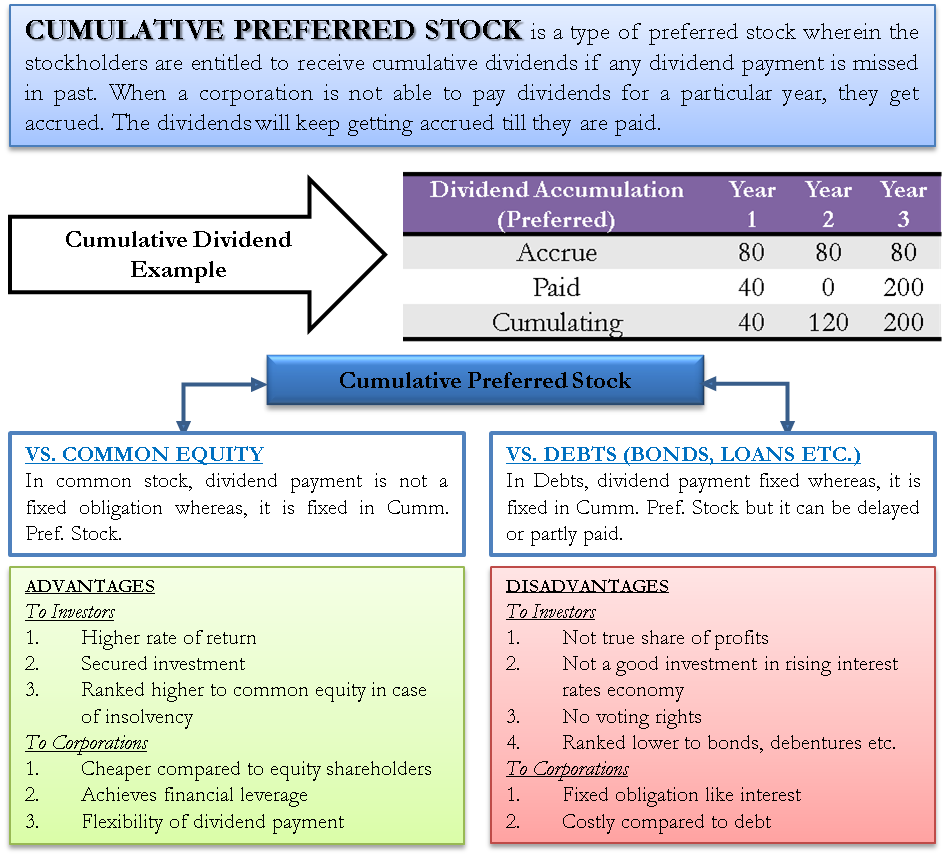

Preferred stocks usually pay dividends quarterly. As referenced above cumulative preferred stock is a type of preferred stock.

Retail Investor Org Nitty Gritty Ofpreferred Shares How They Work Investor Education

If they were issued at 20 per stock at 3 dividend rate we can calculate what she is expected to get as dividends using the preferred dividend formula.

. Annual dividend on preferred stock. If the preferred stock is cumulative. Annual Dividend Rate Par Value If the payment frequency is quarterly the dividend paid every quarter is Quarterly Dividend Annual Dividend 4.

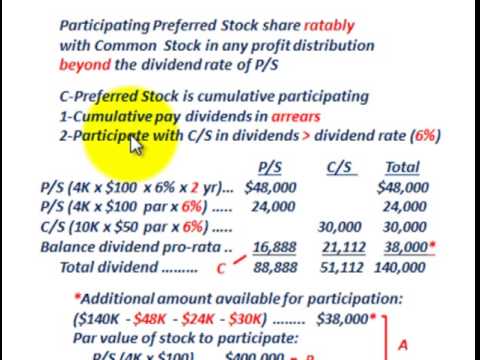

Return to Top Formulas related to Preferred Stock PV of Perpetuity Perpetuity Payment Perpetuity Yield PV of Preferred Stock Calculator. The preferred stock dividends formula is par value x dividend rate x position skipped dividends. With an unlimited useful life and a forever-ongoing fixed dividend payment.

Cumulative Dividend 5 x 100 5 Dividend per preferred share Since Colin is looking to purchase 1000 preferred shares he would be entitled to 5000 annually. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P. Preferred stocks typically have fixed dividend payments based on the stocks par value.

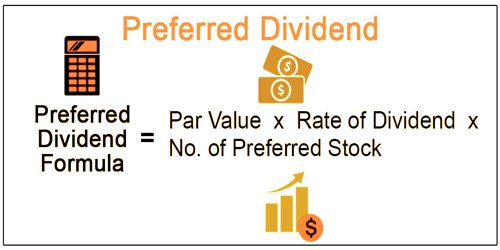

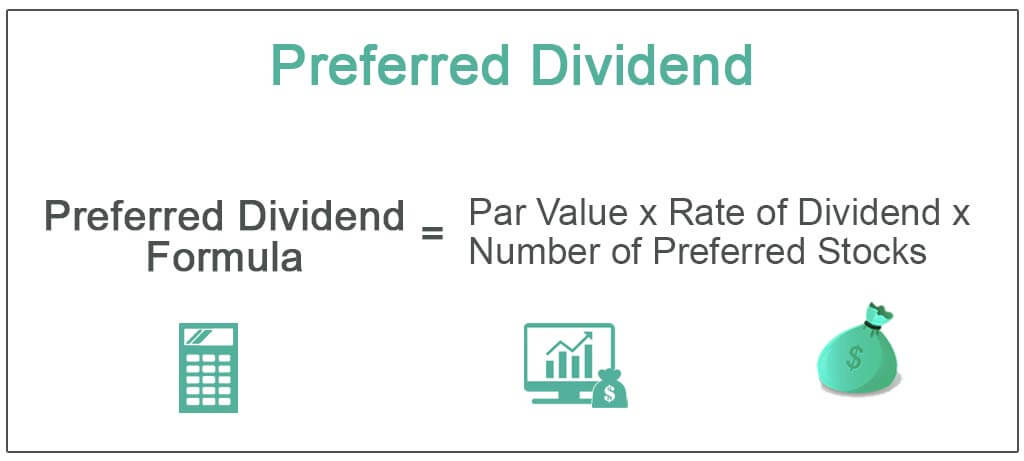

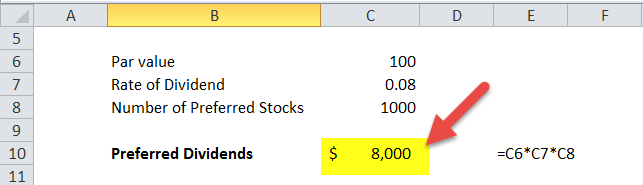

Visit The Official Edward Jones Site. Preferred Dividend formula Par value Rate of Dividend Number of Preferred Stocks 100 008 1000 8000. Preferred dividend Par value x Rate of dividend x Number of preferred stock.

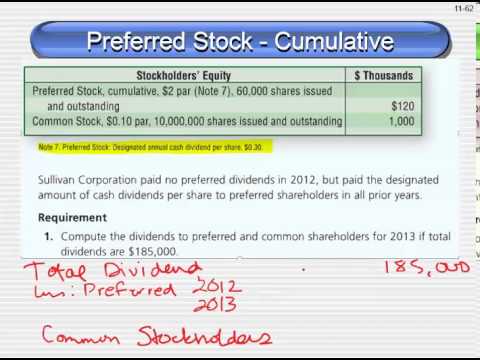

Cumulative preferred stock contains a provision requiring that any missed dividend payments be paid out to. In other words par value is the face value of one share of stock. Customizable Tools for Your Strategy.

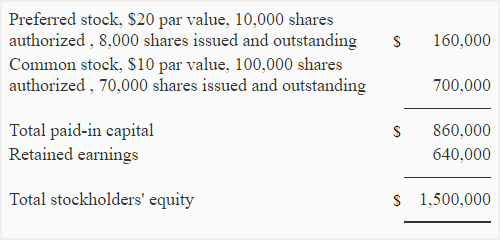

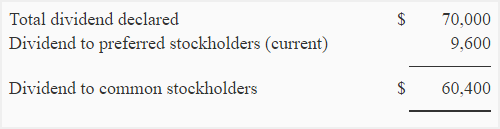

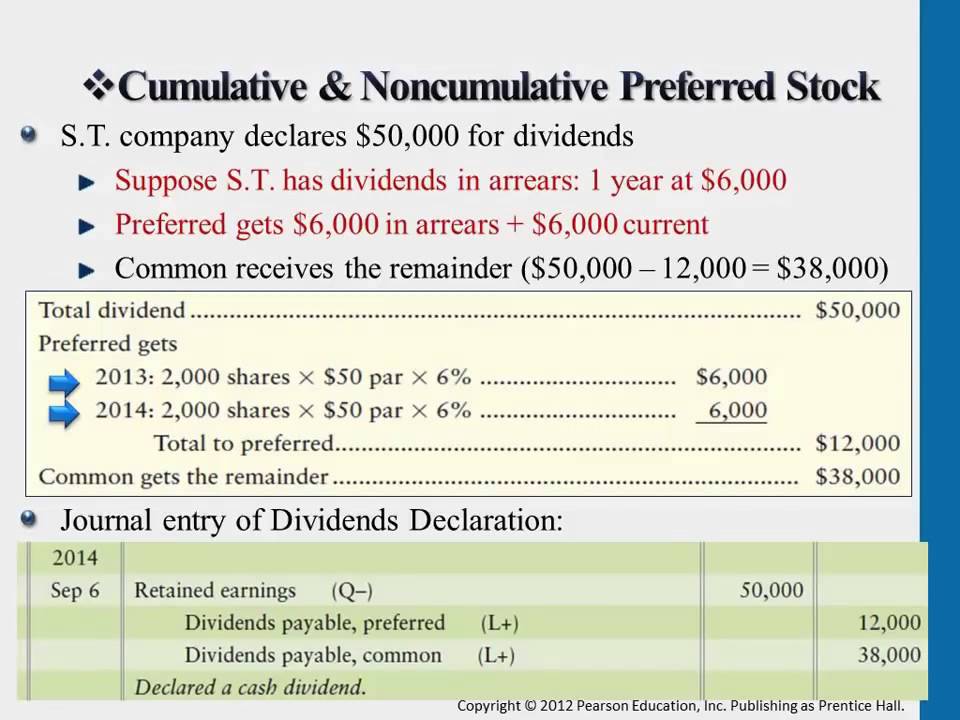

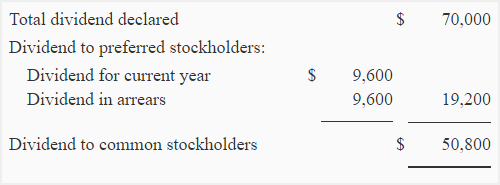

The annual dividend is 100 1000 par value times 010. In this case the cumulative dividend on 6 preferred stock will be paid first to preferred stockholders and the remaining amount will then be deemed available for distribution to common. 160000 06 9600.

Dividends are paid out regularly such as quarterly or annually. It successfully paid up dividends for 2019 and 2020. It also has ordinary shares worth 5 million.

The company calculates the amount to pay to preferred shareholders first. Preferred Dividend Formula Number of preferred stocks Par Value Rate of Dividend Preferred Dividend 1500 007 150 Preferred Dividend 15750 It means that each year Anand will get 15750 preferred dividends. The remaining amount goes to the common shareholders.

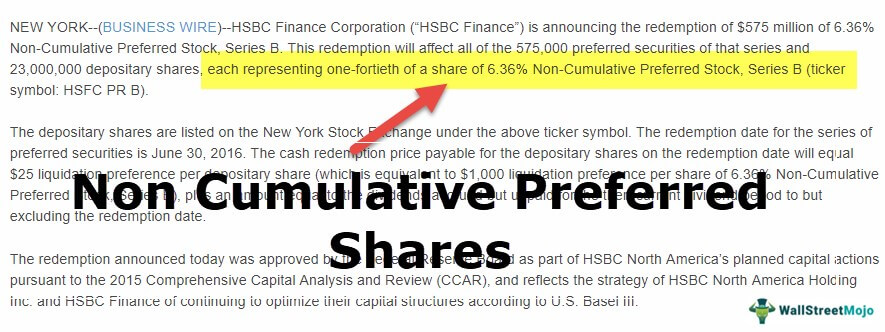

If the preferred stock is noncumulative. When the board of directors meets it determines the total dividend amount to be paid. Ad How to Avoid Picking Losers.

Annual preferred stock dividend Par value x Dividend rate Assume you have a. Cumulative preferred stock is a type of preference share that has a provision that mandates a company must pay all dividends including those that were missed previously to cumulative preferred. First calculate the preferred stocks annual dividend payment by multiplying the dividend rate by its par value.

If you LIKE dividends youll LOVE Dividend Detective. Preferred shares during an economic downturn Colin recently purchased 1000 preferred shares of ABC Company. New Look At Your Financial Strategy.

Number of preferred stock 2000. Cumulative Dividend Formula Preferred Dividend Rate Preferred Share Par Value Where Preferred Dividend Rate The rate that is fixed by the company while issuing the shares. Explanation of Preferred Dividend Formula.

Cumulative preferred stock not only pays current dividends but it also must eventually pay out any suspended dividends. Rate of dividend 3 100 003. Cost of Preferred Stock Formula Cost of Preferred Stock Preferred Stock Dividend Per Share DPS Current Price of Preferred Stock Similar to common stock preferred stock is typically assumed to last into perpetuity ie.

First calculate the preferred stocks annual dividend payment by multiplying the dividend rate by its par value. Dividend Formula The formula for calculating the dividend in these instruments is as follows. Ad Powerful Platforms Built for Traders by Traders.

This feature of arrear payment is only available with the cumulative preferred stock The Cumulative Preferred Stock Cumulative preferred stock is a class of shares wherein any current years unpaid or undeclared dividends. ABC has a 10 cumulative preferred stock at 1 each valued at 1 million in 2019. The company needs to determine whether the preferred stock is cumulative or noncumulative in order to calculate the dividend amount.

If your preferred shares pay a 6 dividend rate and have a par value of 25 you can determine the cumulative dividends with the three steps discussed above. Heres an easy formula for calculating the value of preferred stock. Annual preferred stock dividend Par value x Dividend rate Assume you have a share of cumulative preferred stock with a par value of 1000 and a 10 dividend yield.

Cumulative preferred stock is preferred stock which pays cumulative dividends if a dividend payment is missed. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The preferred stock dividends formula is par value x dividend rate x.

By implication the company will pay a 100000 dividend every year that is 10100 x 1000000. For example if the price is 40 per share and the annual dividend is 4 the rate would be 10 or 10. Par value 20.

Suppose cumulative preferred stock with a 10 dividend rate and a 1000. The formula could be reworked to find the rate or return by dividing the fixed dividend payout by the price. However due to some errors in production the company made a loss.

Features The dividend payment amount is fixed. Preferred share Par Value Preferred shares come with a par value that is the Face value of the share. See how to calculate the Cost of Preferred Stock to a corporation.

Ad Learn more about the VanEck Preferred Securities ex Financials ETF.

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Preferred Dividend Assignment Point

Noncumulative Preference Shares Stock Top Examples Advantages

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Cumulative Noncumulative Preferred Stock Youtube

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Preferred Shares Meaning Examples Top 6 Types

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Dividend Definition Formula How To Calculate

Common And Preferred Stock Principlesofaccounting Com

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Dividends Example Youtube

Cumulative Preferred Stock Define Example Benefits Disadvantages